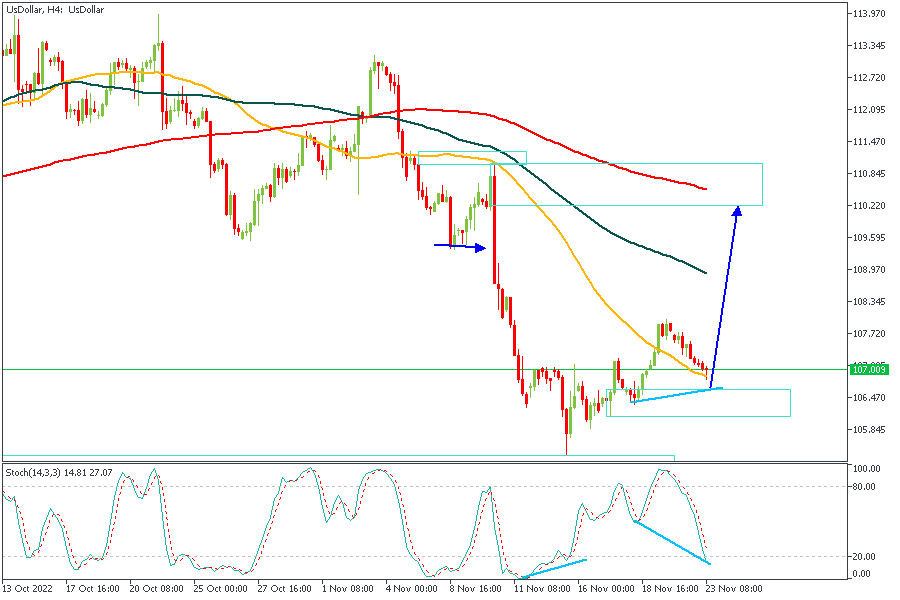

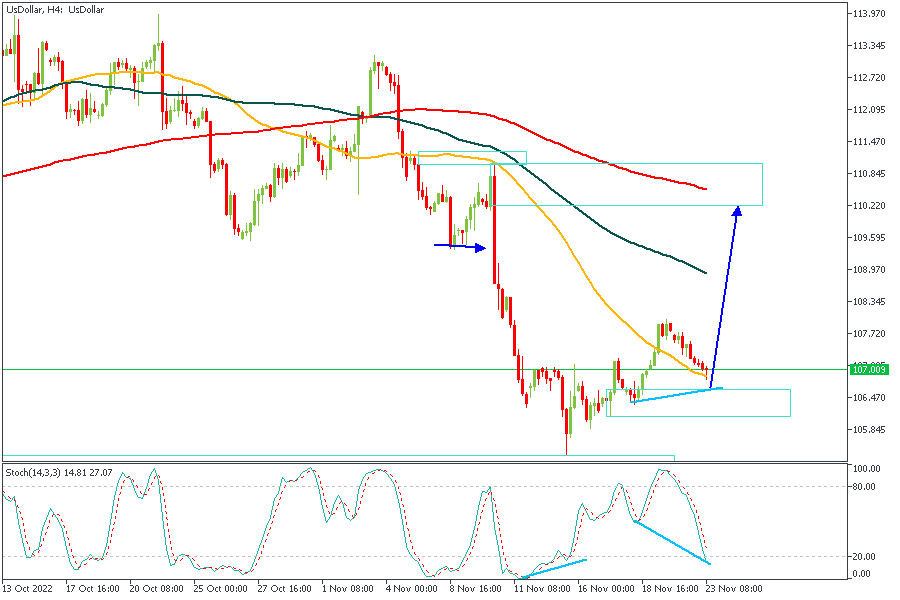

Even though we've only witnessed sluggish movements from the Dollar over the past few weeks, the general idea and bias still seem intact and untampered. The bullish impulse however can be seen as "searching for support". This simply means that price is strategically searching for an area with sufficient demand to push prices higher.

The setup above shows a break out of the small range between the 107 and 104 price area with a possible retest of the drop-base-rally demand zone. There is also a divergence from the stochastics as well as the 50-Moving Average contributing to the trade idea.

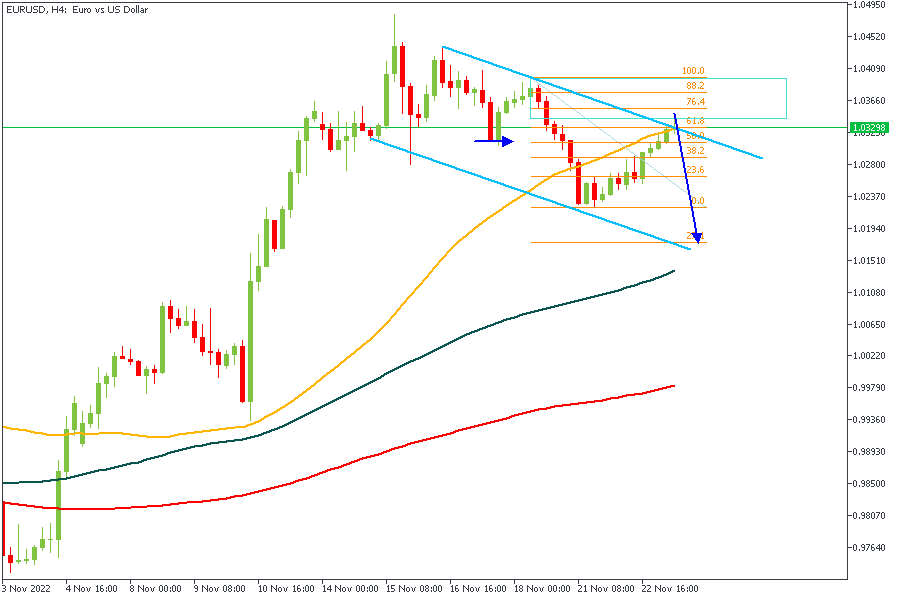

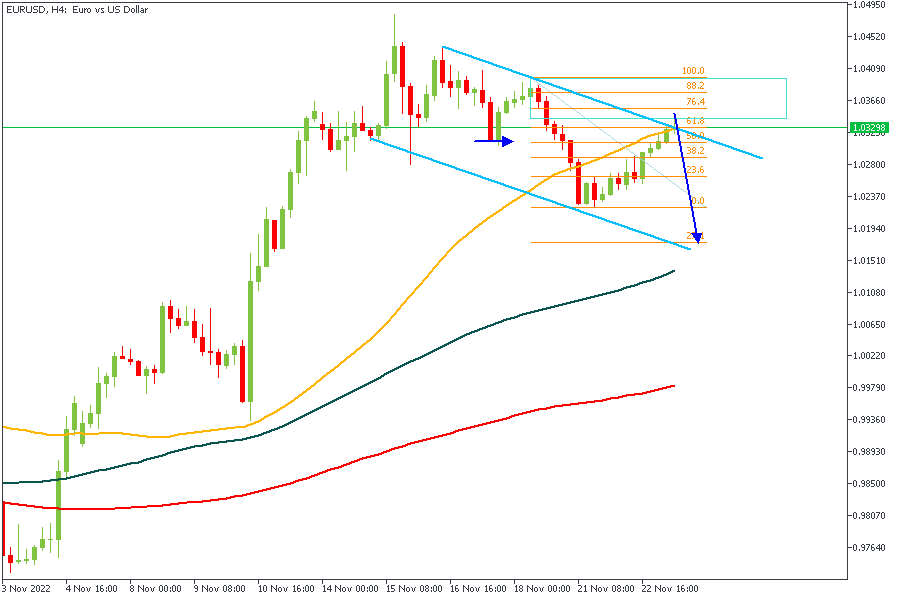

The 4-Hour timeframe of EURUSD presents us with an interesting opportunity. Here, we see the trendline resistance fitting into the rally-base-drop supply zone and the "golden zone" of the Fibonacci retracement (61.8%). All these present us reasons to expect a decline in prices possibly to the 1.018 area.

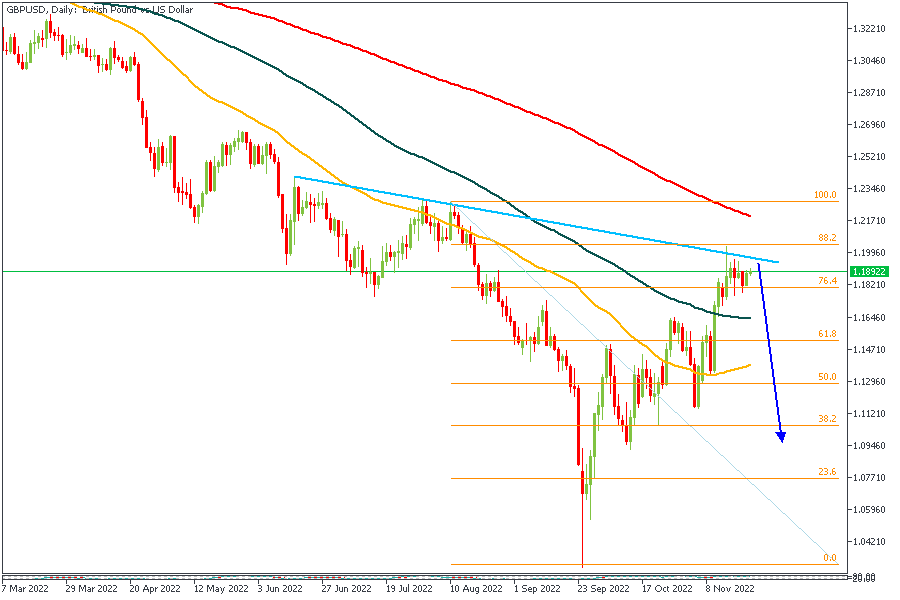

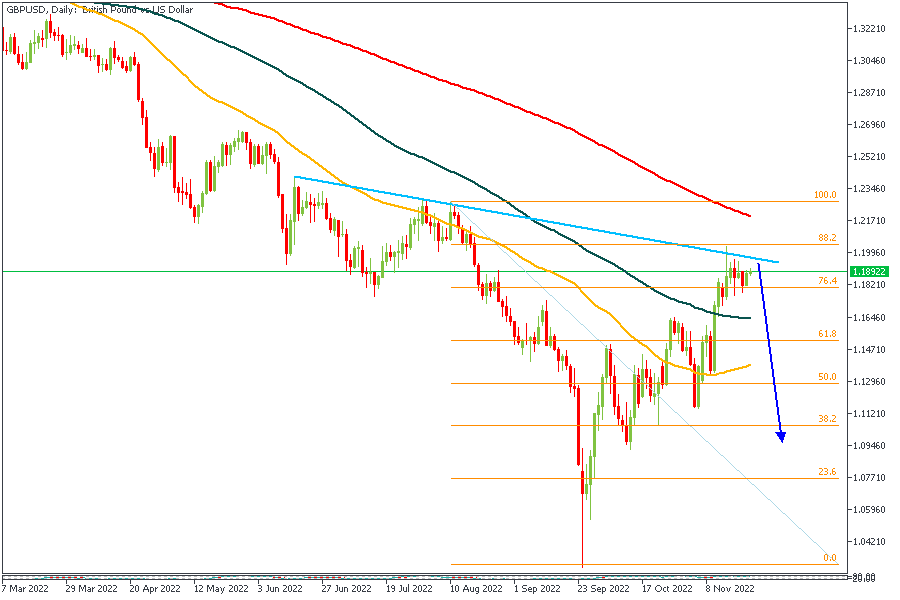

GBPUSD presents a case similar to what we've seen from EURUSD, however, from the Daily Timeframe. We see price filling up the Fair Value Gap (FVG) between 1.997 and 1.892 area with a touch of the 88.2% Fibonacci retracement. The trendline resistance is also a contributory factor to consider in favour of a bearish impulse.

AUDUSD is trading inside the descending channel on the Daily timeframe and has just recently given an initial reaction to the trendline resistance and the FVG (Fair Value Gap). Price is however retracing slightly towards the 100-Day moving average which should serve as sufficient resistance to push prices lower. A long-term selling opportunity could be brewing here!

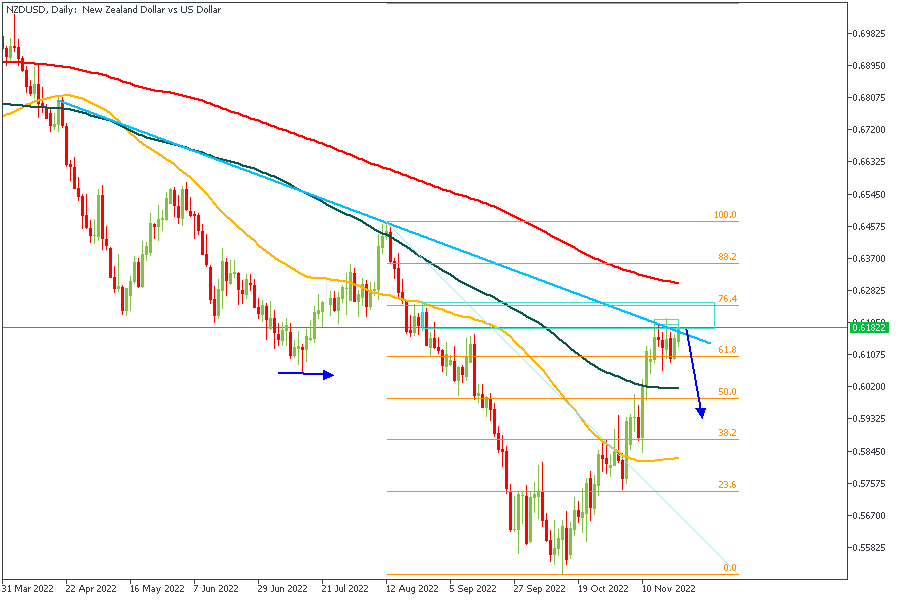

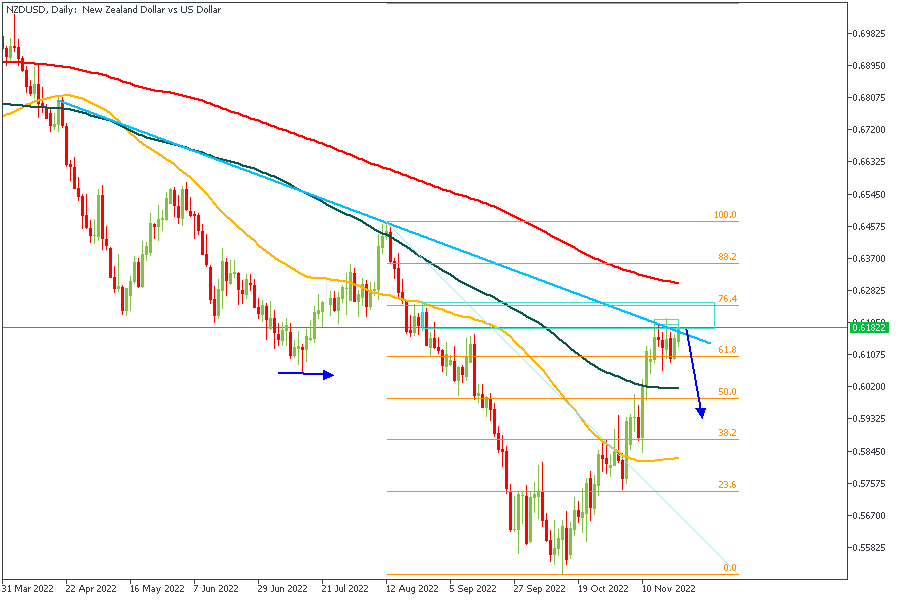

NZDUSD is at the moment 'dancing' around the trendline resistance from April. To the left, we can see the drop-base-drop supply zone aligning with the 76.4% Fibonacci level. Considering the possibility of a stronger Dollar, this looks like a textbook setup for a bearish impulse.